BTC Price Prediction: $127,000 Target in Sight as Technical and Fundamental Factors Align

#BTC

- Technical Breakout: BTC tests upper Bollinger Band with MACD suggesting momentum shift

- Institutional Adoption: Corporate treasury moves (Metaplanet) and ETF expansion (Kazakhstan) provide structural support

- Macro Sensitivity: Short-term volatility expected around inflation data despite bullish long-term indicators

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge as Price Tests Key Levels

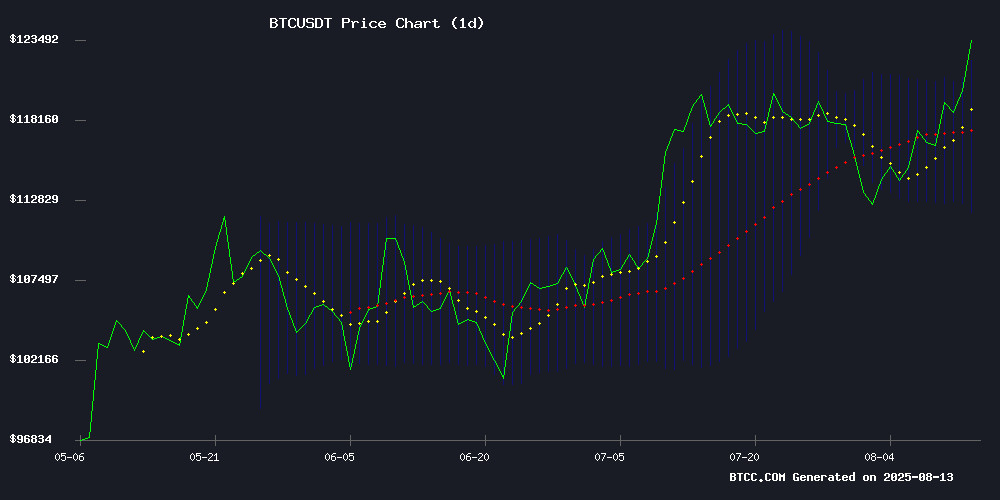

BTCC financial analyst Olivia notes Bitcoin's current price of $119,399.99 sits comfortably above the 20-day moving average ($116,846), suggesting underlying strength. The MACD shows bearish momentum weakening as the histogram narrows (-151.09), while price trades NEAR the upper Bollinger Band ($121,148) - a classic breakout signal. 'The technical setup favors bulls,' Olivia observes, 'with $121,148 as the immediate upside target, followed by $127,000 if institutional flows return.'

Market Sentiment: Institutional Developments Offset Macro Concerns

'We're seeing a fascinating divergence,' comments BTCC's Olivia. 'While miners innovate with AI/renewables and corporations like Metaplanet accumulate (now holding 18,113 BTC), traders remain cautious ahead of inflation data.' The analyst highlights three bullish catalysts: 1) Kazakhstan's spot ETF launch expanding access, 2) Steak 'n Shake's 11% sales boost proving BTC's commercial utility, and 3) Mining giant MARA's HPC expansion signaling industry confidence. 'These fundamentals could overpower short-term technical resistance,' Olivia concludes.

Factors Influencing BTC's Price

Bitcoin Price Eyes Breakout Despite Institutional Calm, Here’s Why

Bitcoin's price approached $119,000 with trading volume hovering around $88 billion, showcasing resilience despite a recent pullback. The dip below $119,000 appears tied to profit-taking ahead of the US CPI release, yet institutional interest remains a bullish counterweight.

Trump Media's updated S-1 filing naming Crypto.com as custodian for a potential Bitcoin ETF has injected fresh optimism. Meanwhile, Capital B and MicroStrategy continue accumulating BTC, with the latter's holdings now exceeding 2,200 coins. BlackRock's spot Bitcoin ETF surpassing $80 billion in assets underscores growing institutional adoption.

On-chain metrics paint a nuanced picture: $5.7 billion in spot volume contrasts with $312 million in ETF outflows, while the realized profit-to-loss ratio sits at 1.9. These mixed signals suggest a market consolidating before its next major move.

Bitcoin Traders Brace for Inflation Data as Market Turns Defensive

Bitcoin traders are shifting into defensive mode ahead of Tuesday’s U.S. Consumer Price Index (CPI) report for July. The 8:30 AM ET release could reshape Federal Reserve policy expectations and dictate near-term crypto market sentiment.

The cryptocurrency’s weekend rally of roughly 5% stalled Monday as traders locked in profits. Over half those gains evaporated in a clear risk-off move before the macroeconomic data drop.

Perpetual futures and spot markets show profit-taking dominated Monday’s action. Open interest plunged as traders unwound positions rather than gamble on CPI volatility. Cumulative volume delta flipped negative—a telltale sign of net selling pressure.

Options markets tell the same cautious story. Derivatives traders are actively hedging against potential downside, with put activity rising sharply across major platforms. The defensive positioning suggests institutional players anticipate possible turbulence after the inflation print.

Hash Miners Revolutionizes Bitcoin Mining with AI and Renewable Energy

Hash Miners is transforming the Bitcoin mining landscape by integrating AI-driven optimization and renewable energy solutions. The platform addresses key pain points of traditional mining—high hardware costs, excessive power consumption, and technical complexity—by offering a streamlined cloud mining service. This innovation lowers barriers to entry, enabling everyday investors to participate and earn stable daily returns.

The company's AI-powered system dynamically allocates computing resources to maximize efficiency and profitability. Coupled with a commitment to green energy, Hash Miners positions itself as a sustainable alternative in an industry often criticized for its environmental impact. The platform's growing user base underscores its appeal to passive-income seekers and crypto enthusiasts alike.

Metaplanet Expands Bitcoin Holdings to 18,113 BTC Amid Institutional Adoption Wave

Tokyo-listed Metaplanet has fortified its position as a major institutional Bitcoin holder with a $61.4 million purchase of 518 BTC, bringing its total stash to 18,113 coins. The acquisition at $118,519 per bitcoin demonstrates continued accumulation despite recent price volatility.

CEO Simon Gerovich reveals the firm's average buy-in stands at $101,911 across its $1.85 billion position, now ranking sixth globally among corporate treasuries. This strategic move coincides with plans to raise $3.7 billion through perpetual shares, signaling long-term conviction in digital assets as viable treasury reserves.

Steak ‘n Shake Credits Bitcoin for 11% Sales Boost in Q2

Steak ‘n Shake’s bold embrace of Bitcoin payments has yielded tangible results, with the fast-food chain reporting a 10.7% surge in same-store sales for Q2 2025. The company attributes part of this growth to its mid-May decision to accept cryptocurrency at all compliant locations across the U.S. and Europe.

The move positions Steak ‘n Shake as an outlier in the fast-food sector, where competitors like McDonald’s and Taco Bell saw modest growth or declines. Bitcoin’s integration appears to have unlocked new customer segments, with the chain publicly thanking the crypto community for their enthusiastic adoption.

This development signals cryptocurrency’s expanding role in mainstream commerce. While other payment innovations have struggled to gain traction in quick-service restaurants, Bitcoin demonstrates measurable impact—a potential blueprint for broader retail adoption.

BTC Price Prediction: Bitcoin Targets $127,000 Within 2 Weeks as Technical Breakout Confirms

Bitcoin's technical indicators are flashing bullish signals, with analysts projecting a potential surge to $127,000 within 14 days. The cryptocurrency, trading at $119,911 as of August 12, 2025, has broken out of a symmetrical triangle pattern—a classic technical setup that often precedes significant price movements.

Market sentiment is riding high, with the Fear & Greed Index hitting 71, indicating strong investor confidence. CoinEdition's conservative target of $124,193 contrasts with Changelly's more aggressive $129,612 forecast, suggesting a 3.8% to 9.18% upside from current levels.

The convergence of these predictions around the $124,000-$130,000 range underscores the market's optimism. Historical trend analysis supports the case for continued momentum, potentially carrying Bitcoin beyond immediate resistance levels.

Bitcoin Price Prediction: Key Support Level at $116,817 Under Scrutiny Amid Macro Headwinds

Bitcoin faces a critical juncture as Matrixport identifies $116,817 as the decisive support level. The cryptocurrency retreated from a brief spike above $122,000 amid selloffs in European and U.S. trading sessions, with bearish technical patterns like a double top formation adding downward pressure.

August's hotter-than-expected Core CPI print has dampened market sentiment, potentially eliminating two anticipated Fed rate cuts this year. Seasonal weakness and slowing inflows into Bitcoin investment products further compound the bearish outlook. Matrixport maintains that patient investors could still see substantial returns, citing sustained capital inflows into crypto funds as a fundamental driver for future upside.

BTC Price Analysis - August 12, 2025

Bitcoin's technical landscape shows consolidation above key support levels, with on-chain metrics indicating accumulation by long-term holders. The $50,000 psychological level remains a critical pivot point for bulls.

Fibonacci retracement levels from the July swing high suggest potential upside targets near $58,400 if current support holds. Trading volume patterns mirror the 2021 bull market structure, though with reduced volatility.

Kazakhstan Launches Central Asia's First Spot Bitcoin ETF

Kazakhstan, a dominant force in Bitcoin mining, has broken new ground with the introduction of Central Asia's inaugural spot Bitcoin ETF. The Fonte Bitcoin Exchange Traded Fund (BETF), managed by Astana-based Fonte Capital, is set to debut on the Astana International Exchange (AIX) on August 13, priced in U.S. dollars.

The ETF distinguishes itself by holding Bitcoin directly, with custody handled by BitGo, a U.S.-regulated custodian offering $250 million in insurance coverage. BitGo's cold storage and secure vaults address institutional and retail concerns over security and counterparty risk.

Kazakhstan's rise as a mining hub followed China's 2021 ban, capitalizing on cheap coal-powered electricity and favorable policies. The ETF operates under the Astana International Financial Centre (AIFC), a jurisdiction positioning itself as a sanctions-resistant haven for digital assets. The AIFC has actively cultivated a regulatory framework for crypto services, attracting licensed exchanges and custodians.

While neighboring Central Asian states proceed cautiously, Kazakhstan's move signals accelerating institutional adoption in emerging markets. The BETF model—combining direct asset exposure with regulated custody—could set a precedent for similar products across developing economies.

Bitcoin Magazine CEO David Bailey Plans $760M BTC Purchase Using VWAP Strategy

David Bailey, CEO of Bitcoin Magazine and advisor to former U.S. President Donald Trump, is orchestrating one of 2025's largest Bitcoin acquisitions. Through Nakamoto Holdings, Bailey will execute a $760 million purchase on August 12 using a Volume Weighted Average Price (VWAP) strategy to minimize market impact.

The scaled-down transaction—originally planned at $1 billion—forms part of Nakamoto Holdings' $763 million treasury reserve target. Private placements have already secured the necessary capital, with additional purchases anticipated in coming months.

Institutional-grade execution tactics will see the order split into smaller parcels throughout the trading day. This approach mirrors standard practice for block trades, blending execution volume with natural market flows to avoid slippage and price dislocation.

Bitcoin Miner MARA Ventures into High-Performance Computing with EDF Subsidiary Stake

MARA Holdings (MARA), traditionally a Bitcoin (BTC) mining firm, is diversifying its portfolio by acquiring a 64% stake in Exaion, a high-performance computing (HPC) subsidiary of French energy giant EDF. The move, noted by H.C. Wainwright, marks a strategic shift as MARA seeks to capitalize on the growing demand for compute power driven by artificial intelligence (AI).

Analyst Kevin Dede highlighted the unexpected nature of the pivot, given MARA's historical focus on Bitcoin mining and grid load balancing. The acquisition positions MARA in the sovereign cloud AI space, where data privacy and scalability are paramount. With Bitcoin halvings on the horizon in 2028 and 2032, the firm is betting on HPC to deliver stronger margins than mining alone.

MARA follows in the footsteps of Core Scientific (CORZ), which last year struck a deal with AI cloud provider CoreWeave. The HPC sector offers premium returns as AI applications demand ever-greater computational resources. H.C. Wainwright reaffirmed its buy rating for MARA, citing the acquisition as a credible entry into a high-growth market.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's Olivia provides these projections:

| Year | Price Target | Catalysts |

|---|---|---|

| 2025 | $127,000-$150,000 | ETF inflows, halving aftermath |

| 2030 | $300,000-$500,000 | Global regulatory clarity, CBDC integration |

| 2035 | $750,000-$1M | Scarcity premium (21M cap), energy-mining synergy |

| 2040 | $1.5M-$2.5M | Network effect as global reserve asset |

Note: These estimates assume continued adoption without black swan events.

HTML